input. The Compensation Committee also solicitscomments from other Board members regarding its recommendations at regularly scheduled Board meetings.

establishes performance goals for the Company’s short-term and long-term performance award programs. Performance goals for our performance award programs are recommended by management based on the Company’s historical performance, strategic direction, and anticipated future operating environment, and are generally established during the first quarter of a performance cycle. These goals are tied to the Company’s annual business plan and operating budget, which are approved by our Board of Directors at or prior to the time the goals are set. The Compensation Committee evaluates the appropriateness of the proposed goals, and from time to time requests Towers Watson to opine on the degree of difficulty inherent in achieving those goals. The Compensation Committee has final authority over goal-setting and approves the goals when satisfied that they are set at reasonable but appropriately challenging levels.15

Role of Consultant

To enhance the Compensation Committee’s ability to perform its responsibilities, the Compensation Committee has in recent years retained the services of an independent compensation consultant. The Compensation Committee retained Watson Wyatt Worldwide (“Watson Wyatt”) to consult and advise on executive compensation issues in early 2009. In July 2009, the Company retained Towers, Perrin, Forster & Crosby, Inc. (“Towers Perrin”) to advise on various compensation and benefits matters in connection with the Merger. At the end of 2009, Towers Perrin and Watson Wyatt merged to form Towers Watson. In 2010, the Compensation Committee retained the services of the newly formed Towers Watson to serve as the Compensation Committee’s independent compensation consultant and to advise on executive compensation matters. In considering the selection of Towers Watson, the Compensation Committee considered Towers Watson’s service to the Company and certain safeguards that Towers Watson implements to assure that the consultant acts independently. The Compensation Committee also considered Towers Watson’s well-developed understanding of our business, particularly in light of the Merger. The decision to retain Towers Watson as an advisor to the Compensation Committee was neither recommended nor opposed by management. As advisor to the Compensation Committee, Towers Watson reviews the total compensation strategy and pay levels for the Company’s named executive officers, examines all aspects of the Company’s executive compensation programs to ensure their ongoing support of the Company’s business strategy, informs the Compensation Committee of developing legal and regulatory considerations affecting executive compensation and benefit programs, and provides general advice to the Compensation Committee with respect to compensation decisions pertaining to the Chief Executive Officer and senior executives.

In addition to executive compensation consulting services provided to the Compensation Committee, Towers Watson provided consulting and actuarial services to the Company on a variety of matters in 2010. The Company paid Towers Watson approximately $2,340,000 for all of the services they provided in 2010. Of that amount, approximately $250,000 related to executive compensation consulting services and a significant portion of the balance related to actuarial services provided in connection with the Company’s pension, health and welfare, and stock-based compensation plans.

Philosophy

As a general proposition, the Compensation Committee believes that overallaggregate expenditures for executive compensation expenditurebase salaries should be managed to the median of salary expenditures when compared to comparable companies. The Compensation Committee also believes that annual and long-term incentive compensation packages forexpenditures should be targeted at median market levels. Targeting the market median, while giving executives in similar positions and with similar responsibilities at manufacturing and services companies of comparable size. Targeting median practices withinthe opportunity to earn more (or less) than this communityamount based on Company performance, ensures that the Company is well positioned tocan attract and retain from within the relevant labor market thehigh caliber of executive talent the Companyit seeks. In setting compensation forOctober 2010, the executive officers, the Committee considers comparative market data delivered by its compensation consultant which reflects the consultant’s understanding8

of prevailing compensation levels in the manufacturing and services market. The consultant also provides information with respect to the compensation paid at the companies in the Company’s Peer Group, which in 2007 consisted of: American Standard Companies, Inc., The Black & Decker Corporation, Cooper Industries, Inc., Danaher Corporation, Illinois Tools Works, Inc., Ingersoll-Rand Company, Masco Corporation, Newell Rubbermaid Inc., Snap-On Incorporated, and The Sherwin-Williams Company. Information from the Peer Group is helpful because it reflects compensation practices within the limited community of organizations with which the Company competes directly for the sale of products and services. These separate but equally relevant data points create ranges of compensation values that the Committee references in using its judgment to set salary levels and incentive opportunities that are consistent with the Company’s overall objectives.

The Committee believes it is important that a significant portion of each executive officer’s compensation opportunity remain at risk with results. The Committee uses its judgment, based on input from management and the Committee’s compensation consultant, to align the degree of at risk pay with external market practices. As a result, the Company’s executive compensation programs are designed so that, at target levels of performance, approximately 50%–60% of an executive’s annual compensation (consisting of salary, short-term incentives and long-term incentives) is at risk with results. In general, the greater the executive’s responsibility, the higher the proportion of his or her compensation which is at risk. Annual cash incentives represent approximately 40% of at risk compensation, and long-term compensation (other than restricted stock units) represents approximately 60% of at risk compensation. The nature of the Company’s at risk pay is described more fully below under “Compensation Components.”

In 2007, theCompensation Committee reviewed the market data provided by its compensation consultantTowers Watson and found that, showed compensation expenditureson average for the Company’snamed executive officers as a group, were conservatively positioned(other than Mr. Archibald), actual compensation was in relationfact targeted very close to the Peer Group practices. The following table identifies that positioning insofar as it relates to base salary, target total cash (base salary plus target bonus), and target total compensation (target total cash plus the grant date value of long-term incentive awards).

intended median positioning. | | | | | | Target Total Compensation |

| | | Base Salary | | Target Total Cash | | Target Total Compensation

(excluding Merger Specific Awards) |

Objective

Targeted Positioning: | | Median | | Median | | Median |

Actual Position Positioning: | | +0.6% ahead of | | | | |

| - vs. Published Surveys | | 2% Above Median | | -7.4% behind3% Above Median | | -13.4% behind9% Above Median |

| - vs. Peer Group | | 1% Below Median | | 2% Below Median | | 1% Below Median |

Peer Group

As previously discussed in the Executive Summary, in 2010 we made changes to our peer group to better reflect the Company’s increased scale, global breadth and complexity. As of the 2010 fiscal year end, the median revenue ($8.9 billion), market capitalization ($7.6 billion), and employee count (33,700) of the peer group are commensurate with that of the Company. The new peer group consists of the following 18 companies:

| Cooper Industries | Illinois Tool Works | Sherwin Williams |

| Danaher Corp. | Ingersoll-Rand | SPX Corp. |

| Dover Corp. | Jarden Corp. | Textron |

| Eaton Corporation | Masco Corp. | Tyco International |

| Emerson Electric | Newell Rubbermaid | W. W. Grainger |

| Fortune Brands | Parker Hannifin | Whirlpool Corp. |

16

Pay Mix

SalariesThe CompanyCompensation Committee believes that aggregate expendituresa significant portion of each executive officer’s compensation opportunity should be at risk in order to ensure that median or above-median compensation is only delivered when business results are strong and we have created value for our shareholders. The mix of compensation between base salary, annual MICP compensation and long-term incentives is targeted such that 70%–85% of our named executive officer’s total annual compensation is at risk and dependent on performance results.

2010 Named Executive Officer Pay Mix

(excluding Merger Specific Awards)

Base Salaries

The table below illustrates the current base salaries should generally be managedof our named executive officers and the increases from 2009 related to the median of salary expenditures incurred at the companies whose practices serve as the Company’s benchmark for pay comparison purposes. Managing to the market median facilitates the Company’s ability to compete in the market for the quality talent the Company looks to attract and retain. Individual base salariesMerger. Salaries may rise aboveexceed or fall belowtrail the median for a particularvariety of reasons, including performance considerations, experience level, length of service in current position, based on a number of factors. In general, base salaries may beadditional responsibilities, value to the Company beyond the core job description, or retention risk. As noted above, the named executive officers (other than Mr. Archibald) are aligned with median if, in the Committee’s view, a particular executive’s performance exceeded expectations, an executive takes on additional responsibilities, the executive has a significant tenure with the Company, or the executive has received a competing offer. Base salaries are reviewed at twelve to sixteen month intervals, and adjusted from time to time to realign salaries with market levels, individual performance and incumbent experience. The Committee also evaluates salaries relative to others within the Company and may, on occasion, make adjustments to salaries or other elements of total compensation, such as annual and long term bonus opportunities, where a failure to make such an adjustment would result in a compensation imbalance that the Committee deems inappropriate.levels.

| | | 2009 | | 2010 |

| John F. Lundgren | | $1,050,000 | | $1,250,000 |

| Donald Allan, Jr. | | $350,000 | | $475,000 |

| Jeffery D. Ansell | | $400,000 | | $475,000 |

| Nolan D. Archibald | | N/A | | $1,500,000 |

| James M. Loree | | $610,000 | | $750,000 |

Performance-Based Annual Cash Incentives (MICP Awards)Incentive Compensation - MICPEach

All of our executive officers, participatesincluding the named executive officers, participate in the annual incentive compensation programs under the Company’s 2006 Management Incentive Compensation Plan (“MICP”), which isPlan. These programs are designed to compensatebalance the complementary short-term goals of profitability and stability, encouraging our executives to maximize profitability and other managers based on achievement ofefficiency while promoting stability in our annual9

corporate and divisional goals, as well as on achievement of individual goals (for those who operating condition. The program measures are not named executive officers). Under the MICP, each participant has an opportunity to earn a threshold, target or maximum bonus amount that is contingent upon achieving the relevant performance goals. The particular performance goals are established during the first quarter of each calendar year and reflect those measures which the Company views as key indicators of successful performance. For 2007, the corporate goals consisted of sales growth,evenly weighted between earnings per diluted share (EPS)(“EPS”) and cash flow multiple (operating cash flow less capital expenditures divided by net earnings) and were weighted as follows: sales growth (20%); EPS (60%) and cash flow multiple (20%). The weighting of these goals was designed to establish the balance in results that the Company had deemed necessary for success for the 2007 fiscal year and, thereby, to appropriately focus managementExecutives with group or divisional responsibility are also measured on achieving those results. In the case of divisional managers, additional performance goals were established with respect to divisional operating margin fulfillment, and working capital management eachmanagement. With the exception of Mr. Archibald’s target award, which was deemed by the Committee to be an important measure of divisional contribution to overall corporate success.

The specific targets relating to each of these performance goals are tied to the Company’s annual business plan and operating budget, each of which is approved by our Board of Directorsestablished in his Employment Agreement at or prior to the time performance goals$1,875,000, target awards are set for our annual and long-term incentives. In setting these goals, the Committee considers management’s recommended performance objectives, the Company’s performance in the prior year, the annual plan and operating budget, and the nature of the Company’s operating environment. Once satisfied with the degree of difficulty associated with goal achievement, the Committee approves the targets for each performance cycle. As a general rule, the Committee seeks to establish goals such that the likelihood of missing the target is at least as high as the likelihood of achieving it based on reasonable assumptions and projections at the time of grant, though the Committee may establish the target goal at a higher or lower level in appropriate circumstances.

Criteria Used for Annual MICP Awards

With respect to fiscal year 2007, the annual award for each of Messrs. Lundgren, Loree and Davis was contingent solely on the achievement of corporate sales, EPS, and cash flow goals; for Messrs. McIlnay and Paternot seventeen and one-half percent of their annual award was contingent on the achievement of the corporate EPS goal and eighty-two and one-half percent was contingent on the achievement of performance goals relating to their particular divisions. The weighting of goals for divisional managers, including Messrs. McIlnay and Paternot, was designed to establish the balance in results that the Company deemed necessary for successful performance of the respective divisions while maintaining incentives for divisional managers also to consider and strive for the success of the Company as a whole. The table below identifiespercentage of each officer’s base salary. For 2010, the blend of goals with respect to which MICP awards are earned for the Company’s named executive officers.

| | | | | | | | | | | | | | | | | | |

| | | Corporate | | | Division | |

| | | Sales | | | EPS | | | Cash

Flow | | | Operating

Margin | | | Stanley

Fulfillment

System | | | Working

Capital | |

Lundgren | | 20 | % | | 60 | % | | 20 | % | | — | | | — | | | — | |

Loree | | 20 | % | | 60 | % | | 20 | % | | — | | | — | | | — | |

Davis | | 20 | % | | 60 | % | | 20 | % | | — | | | — | | | — | |

McIlnay | | | | | 17.5 | % | | | | | 40 | % | | 25 | % | | 17.5 | % |

Paternot | | | | | 17.5 | % | | | | | 40 | % | | 25 | % | | 17.5 | % |

Awards under MICP for 2007.

Each of our named executive officers is extended aofficer target bonus opportunity that is earned when overall achievement with respect to the performance goals equalsopportunities were: Mr. Lundgren – 150%, Mr. Allan – 80%, Mr. Ansell – 80%, and Mr. Loree – 100%. The target bonuses are defined in terms of fixed percentages of the officer’s base salary, and they are representative of prevailing bonus opportunities in the benchmark community. Actual bonuses earned for the year can be as high asMICP payouts will vary from 0% to 200% of the target when results

10

equal or exceedbonus opportunity depending on results. The weighting of measures, potential bonus payouts, and actual bonuses earned for 2010 performance are illustrated in the table below.

| | | Weighting of Measures | | | | | | | | Weighted Avg. | | |

| | | Corporate | | Group | | Potential Bonus Payouts | | Results on All | | |

| | | | | Cash | | Operating | | Working | | | | | | | | Measures | | |

| | | EPS | | Flow | | Margin | | Capital | | Threshold | | Target | | Maximum | | (% of target) | | Payout |

| John F. Lundgren | | 50% | | 50% | | 0% | | 0% | | $937,500 | | $1,875,000 | | $3,750,000 | | 200% | | $3,750,000 |

| Donald Allan, Jr. | | 50% | | 50% | | 0% | | 0% | | $190,000 | | $380,000 | | $760,000 | | 200% | | $760,000 |

| Jeffery D. Ansell | | 25% | | 25% | | 25% | | 25% | | $190,000 | | $380,000 | | $760,000 | | 200% | | $760,000 |

| Nolan D. Archibald | | 50% | | 50% | | 0% | | 0% | | | | $1,875,000 | | | | 200% | | $1,875,000 |

| James M. Loree | | 50% | | 50% | | 0% | | 0% | | $375,000 | | $750,000 | | $1,500,000 | | 200% | | $1,500,000 |

17

For 2010, the Company delayed setting performance

maximum; they amountgoals until April due to

just 50%the Merger, and established goals for a nine month performance period that ran from April 4, 2010 (the first day of the

target whenCompany’s second quarter) through the

level of achievement equals the performance threshold. Bonuses are interpolated when performance results rest between threshold, target and maximum levels.For 2007, our EPS from continuing operations was $4.00, which represented 103%end of the target level; our sales growth was 12%, which represented 104% of the target level; and our cash flow multiple was 136% which represented 136%Company’s 2010 fiscal year. Actual performance in 2010 exceeded 2010 corporate performance goals, resulting in a payout equal to 200% of target level.for corporate executives. The following table illustrates how, as a resultcorporate performance goals and results for the 2010 performance period are illustrated below:

| | | Threshold | | Target | | Maximum | | 2010 Result |

| EPS | | $2.13 | | $2.45 | | $2.76 | | $3.18 |

| Cash Flow Multiple | | 80% | | 100% | | 120% | | 164% |

The results of theseMr. Ansell’s division exceeded performance levels, Messrs. Lundgren, Loree and Davis earned bonuses equal to 170% of their target bonuses. | | | | | | | | | | | | | | | | |

Goal | | Results | | | Bonus Factor | | | | | Goal Weight | | | | | Target Bonus Earned | |

Sales | | 104 | % | | 200 | % | | x | | 20 | % | | = | | 40 | % |

EPS | | 103 | % | | 150 | % | | x | | 60 | % | | = | | 90 | % |

Cash Flow | | 136 | % | | 200 | % | | x | | 20 | % | | = | | 40 | % |

| | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | 170 | % |

Basedgoals established for that division. Accordingly, based on the corporate results discussed above and the results of their respective divisions, Messrs. McIlnay and Paternothis division, Mr. Ansell earned annual bonusesa bonus equal to 101%200% of his target bonus. The specific divisional operating margin and 115%working capital goals and results are not disclosed as the disclosure of their target bonuses respectively. The following tables illustratesuch information would result in competitive harm to the formulationCompany and would be of their awards for 2007 results.

| | | | | | | | | | | | | | | | |

Goal | | Results | | | Bonus Factor | | | | | Goal Weight | | | | | Target Bonus Earned | |

Mr. McIlnay | | | | | | | | | | | | | | | | |

EPS (Corporate) | | 103 | % | | 150 | % | | x | | 17.5 | % | | = | | 26 | % |

Operating Margin | | 98 | % | | 67 | % | | x | | 40 | % | | = | | 27 | % |

Stanley Fulfillment System | | 133 | % | | 133 | % | | x | | 25 | % | | = | | 34 | % |

Working Capital | | 98 | % | | 80 | % | | x | | 17.5 | % | | = | | 14 | % |

| | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | 101 | % |

| | | | | | |

Mr. Paternot | | | | | | | | | | | | | | | | |

EPS (Corporate) | | 103 | % | | 125 | % | | x | | 17.5 | % | | = | | 22 | % |

Operating Margin | | 105 | % | | 150 | % | | x | | 40 | % | | = | | 60 | % |

Stanley Fulfillment System | | 100 | % | | 100 | % | | x | | 25 | % | | = | | 25 | % |

Working Capital | | 86 | % | | 46 | % | | x | | 17.5 | % | | = | | 8 | % |

| | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | 115 | % |

Long-Term Incentives

limited additional use to investors. The Company does not disclose operating margin and working capital results for specific divisions; accordingly, there would not be comparable financial results to which an investor could refer.

Long-Term Incentive Compensation

The Compensation Committee believes that the most effective means of maximizing long-term performance is to create an ownershipestablishing a culture among our executive officers. We implement this philosophy by granting stock-based awards under the Company’s long term incentive plan (“LTIP”). A portion of these awards vest based on continued employment and a portion vest on achievement of pre-determined performance goals. In each case, the awards are settled in shares of our common stock.Time based awards are granted in the form of stock ownership is an effective way to incentivize executives to achieve sustainable performance results and maximize long-term shareholder value. To that end, the Company is authorized to grant equity-based awards, including stock options, time-vesting restricted shares or units (“RSUs”), and time-basedperformance-vesting shares or units under its 2009 Long-Term Incentive Plan. In 2010, the Company granted stock options, RSU’s and performance-vesting restricted stock units (RSUs). The Company believes that by blending options and RSUs we replicate(“performance units”) to its named executive officers as part of their regular compensation packages. Excluding Merger-specific grants awarded in 2010, the stock-based award pattern that prevails in the Company’s Peer Group and in the external market generally. Our practice of granting a combination of stock options and RSUs also is economical because it takes fewer RSUs thanvest in four equal annual installments on the first four anniversaries of the grant date; the stock options to deliverexpire 10 years from the grant date. The performance units for the performance period commencing in 2010 will be earned or forfeited following the conclusion of a target award value.

The portions of our awards that vest contingent on achievement take the form of performance-based RSUs. Performance based RSUs (“2.5 year performance units”) are earned basedcycle depending on the achievement of pre-established corporateEPS and ROCE performance goals overfor each year, or portion thereof, in the cycle and a three-year performance period. One-half2.5 year TSR goal. The allocation of the awardlong-term incentive values among stock options, RSUs and performance units varies by named executive officer. Our most senior officers have a greater percentage of their long-term incentive awards allocated to performance units than other officers and employees do because they have the greatest ability to influence the financial measures underlying the program. The following table shows the 2009 and 2010 allocation of regular long-term incentive awards for our named executive officers (other than Mr. Archibald):

| | | 2010 | | 2009 |

| | | Stock | | | | Performance | | Stock | | | | Performance |

| | | Options | | RSUs | | Units | | Options | | RSUs | | Units |

| John F. Lundgren | | 19% | | 24% | | 57% | | 15% | | 57% | | 28% |

| Donald Allan, Jr. | | 29% | | 37% | | 34% | | 18% | | 59% | | 23% |

| Jeffery D. Ansell | | 29% | | 37% | | 34% | | 18% | | 57% | | 26% |

| James M. Loree | | 22% | | 28% | | 50% | | 21% | | 57% | | 23% |

The performance unit component of our current long-term incentive program is designed to pay out at market-competitive levels only when we achieve and sustain profitability and market return goals over three years. Accordingly, 40% of performance unit payouts are contingent on11

achieving stated levelsupon improvement in earnings per share (“EPS”) and one-half is based on targets relating to return on capital employed (“ROCE”), 35% on EPS growth, and 25% on total shareholder return relative to our peer group (“TSR”). The ROCE computation for the LTIP performance targets is defined as net earnings divided by a two point average of capital employed; net earnings adds back after-tax interest expense and intangibles amortization, and capital employed represents debt plus equity less cash. The Company believesTSR calculation is based on an annualized rate of return reflecting share price appreciation and dividends paid during the measurement period with starting and ending prices measured as 20-day averages to account for daily trading volatility. For performance units granted prior to 2009, including the recently concluded 2008-2010 performance unit grant, award payouts were based only on the equally weighted measures of ROCE and EPS in the last year of the cycle. The Compensation Committee added the TSR measure in 2009 in order to more directly link compensation earned by our executives to shareholder value creation. While we may re-evaluate the measures used in the performance unit program in future years, or the weighting of those measures, we believe that measuring performance equally betweenROCE, EPS, and ROCE provides appropriate incentivesTSR currently provide effective tools for management to optimizemeasuring the principal financial drivers that generate shareholder returnvalue we create and that highlighting the importancesustain, assessing our achievement of these measures by tying them tostrategic goals, and evaluating our long-term performance and potential.

18

The Company does not publicly disclose the performance

based RSUs reinforcesgoals for its three-year performance award programs until after the performance cycle has been completed and the Company’s

questfinancial statements for

continued growth.the relevant period have been filed. Performance goals for each performance cycle are recommended by management based uponon the Company’s historical performance, strategic direction, and anticipated future operating environment, and are generally established during the first quarter of the performance cycle. The Compensation Committee considers management’s recommended performance goals, the Company’s performance to dateperformance-to-date and strategic direction, and the nature of the Company’s future operating environment, and once satisfied with the degree of difficulty associated with goal achievement, approves the targets for each performance cycle. As a general rule, the Compensation Committee seeks to establish goals such that the likelihood of missing the target goal is at least as high as the likelihood of achieving the target goal based on reasonable assumptions and projections at the time of grant, thoughgrant; the Compensation Committee may establish the target goal at a higher or lower level in appropriate circumstances.

For the 2010 - 2012 performance cycle, which commenced July 4, 2010, the Compensation Committee delayed establishing performance goals due to the Merger. In order to ensureestablishing performance goals for that the basis upon which management’s performance is measured remains consistent over a performance cycle, the Compensation Committee hasconsidered the discretionlikely effects of the Merger and determined that the likelihood of missing the target goal is at least as high as the likelihood of achieving the target goal.

Target performance unit awards are set as a percentage of each officer’s base salary and converted to adjust the manner in which EPS and ROCE are determineda number of shares at the endbeginning of eachthe three-year performance period. For the 2010-2012 performance cycle, to take into account certain non-recurring events (suchthe named executive officer threshold, target, and maximum performance unit opportunities, as significant acquisitionsa percentage of base salary were as follows: Mr. Lundgren – 150/300/500%, Mr. Allan – 40/80/160%, Mr. Ansell – 40/80/160%, and divestitures) duringMr. Loree – 125/250/400%. The following tables illustrates the award opportunities associated with the 2010-2012 performance unit cycle and the Company’s Total Shareholder Return versus its Peer Group.goals, actual performance results and payouts associated with the recently completed 2008-2010 performance unit cycle.

2010-2012 Performance Cycle*

| | | Potential Performance Units Earned |

| | | Threshold | | Target | | Maximum |

| John F. Lundgren | | 36,721 | | 73,443 | | 122,405 |

| Donald Allan, Jr. | | 3,721 | | 7,442 | | 14,884 |

| Jeffery D. Ansell | | 3,721 | | 7,442 | | 14,884 |

| James M. Loree | | 18,361 | | 36,721 | | 58,754 |

| * | | Mr. Archibald will receive a cost synergy bonus pursuant to his employment agreement on March 12, 2013, provided certain goals are met, and therefore is not a participant in the Company’s long term performance award programs. |

2008-2010 Performance Cycle

| | | 2008 – 2010 Target | | Potential Performance Units Earned | | Actual Results* | | |

| | | Performance Goals | | | | | | | | | | | | |

| | | ROCE | | EPS | | Threshold | | Target | | Maximum | | ROCE | | EPS | | Payout |

| John F. Lundgren | | 15.6% | | $4.57 | | 15,780 | | 31,560 | | 63,120 | | 10.7% | | $3.88 | | 0 |

| Donald Allan, Jr. | | 15.6% | | $4.57 | | 1,052 | | 2,104 | | 4,208 | | 10.7% | | $3.88 | | 0 |

| Jeffery D. Ansell | | 15.6% | | $4.57 | | 2,209 | | 4,418 | | 8,836 | | 10.7% | | $3.88 | | 0 |

| James M. Loree | | 15.6% | | $4.57 | | 4,881 | | 9,762 | | 19,524 | | 10.7% | | $3.88 | | 0 |

| * | | In determining whether the performance goals were met for the 2008-2010 LTIP, merger and acquisition related costs incurred in 2010 primarily with respect to the Merger were excluded for purposes of computing ROCE and EPS; EPS also was adjusted to exclude a second-quarter 2010 tax-related benefit. The results shown in the foregoing table reflect these adjustments. |

Special Compensation

Working Capital Incentive Program

In July 2010, the Company intends that any adjustment of this type would ensure that the results are comparable to the originally established targets, such as for significant acquisitions or divestitures consummated after the performance goals were established,granted certain employees, including Messrs. Lundgren, Allan, Ansell, and would not constitute a modification of original performance targets established for the performance cycle.For the 2005 to 2007 performance period, each of our named executive officers was extendedLoree, the opportunity to earn shares contingentawards pursuant to a working capital incentive program. The awards were approved by the Compensation Committee on July 15, 2010 under the Company’s 2009 Long-Term Incentive Plan and will be earned only if the Company achieves an established number of working capital turns by June 30, 2012 and sustains that rate of working capital turns for at least six months thereafter. The program is modeled on the Company’s achievement with respectSpecial Bonus Program adopted for the legacy Stanley business in 2007, pursuant to EPSwhich the Company achieved seven times working capital turns and ROCE goals. Each officer could earn6.2 times inventory turns by the target numberend of shares2009. We believe working capital turns is an important measure of our efficiency and overall performance standards. Award opportunities under this program are payable in stock or cash, at the Compensation

19

Committee’s discretion, for 100% overall goal achievement. As many as 200% of the target number of shares could be earnedsenior executives and in cash for overachievement, and as few as 50% of the target number of shares could be earned for threshold performance.other eligible participants. The number of shares that couldmay be earned by our named executive officers is displayedunder the 2010 Working Capital Incentive Program are as follows: Mr. Lundgren – 36,721, Mr. Allan – 7,442, Mr. Ansell – 7,442, and Mr. Loree – 14,689.

In July 2010, the Compensation Committee determined that the Company had achieved the performance goals associated with the 2007-2009 Special Bonus Program. As noted above, the goals of seven times working capital turns and 6.2 times inventory turns were achieved by the end of 2009, and the working capital turns goal was sustained for six months thereafter (excluding the effects of the Merger). The Committee elected to distribute awards in cash rather than shares. As a result, the awards were paid to our named executive officers in cash (excluding Mr. Archibald, who was not a participant in the program) in August 2010. The payouts associated with this program are illustrated in the table

below. | | | | | | |

| | | Threshold | | Target | | Maximum |

Mr. Lundgren | | 8,155 | | 16,311 | | 32,622 |

Mr. Loree | | 3,996 | | 7,992 | | 15,985 |

Mr. Davis | | 1,767 | | 3,534 | | 7,068 |

Mr. McIlnay | | 2,447 | | 4,893 | | 9,787 |

Reported earnings per diluted sharebelow:

| | Payment Amount |

| John F. Lundgren | | $592,800 |

| Donald Allan, Jr. | | $88,920 |

| Jeffery D. Ansell | | $118,560 |

| James M. Loree | | $414,960 |

Specific Awards Granted in Connection with the Merger

In connection with the Merger, in order to address retention risk and discrepancies in compensation packages between Stanley and Black & Decker executives and create incentives to help ensure the success of the Merger, the Compensation Committee approved the following awards:

- RSU grants to members of the Company’s senior management team, including executive officers, who had been employed by The Stanley Works or one of its subsidiaries prior to the Merger. These awards were granted on March 12, 2010 and vest in two equal installments on March 12, 2014 and March 12, 2015. Messrs. Allan and Ansell each received a grant of 50,000 RSUs.

- RSU grants to Messrs. Lundgren and Loree pursuant to the terms of their employment agreements. These awards were granted on March 15, 2010 and vest in two equal installments on March 12, 2014 and March 12, 2015.

Mr. Lundgren received a grant of 325,000 RSUs, and Mr. Loree received a grant of 200,000 RSUs.

- RSU grants to executive officers and other employees who were assigned specific management responsibilities with respect to the integration of the Stanley and Black & Decker businesses. None of the named executiveofficers received one of these grants.

- A grant of 1,000,000 stock options to Mr. Archibald pursuant to the terms of his employment agreement. This award will vest in full on March 12, 2013.

- RSU grants to members of the Company’s senior management team, including executive officers, who had been employed by The Black & Decker Corporation or one of its subsidiaries prior to the Merger. These awards were granted on April 19, 2010 and vest in two equal installments on December 31, 2012 and May 3, 2013. None of thenamed executive officers received one of these grants.

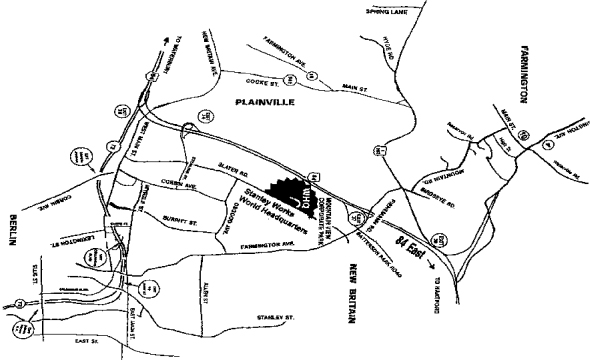

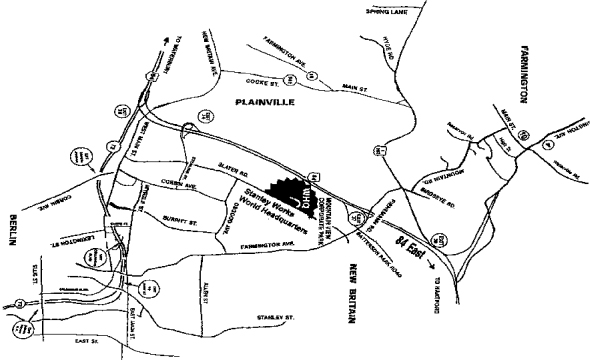

- A cash bonus to Mr. Ansell in connection with his relocation from New Britain, Connecticut to Towson, Maryland totaling $550,000 of which $160,000 was immediately vested, $130,000 vested on December 31, 2010, and the balance will vest in two equal installments of $130,000 each on December 31, 2011 and December 31, 2012. This award was granted in July, 2010.

Benefits & Perquisites

Retirement Benefits

The Compensation Committee believes that offering a full complement of compensation and benefit programs typically extended to senior executive officers is crucial to the attraction and retention of high-caliber executive talent. Prior to the Merger, the Company offered various retirement programs to its executive officers, including the Stanley Account Value Plan; the Supplemental Retirement and Account Value Plan for fiscal yearSalaried Employees of The Stanley Works; and a CEO Make-Whole Retirement Arrangement for Mr. Lundgren. The Company also maintained The Stanley Works Supplemental Executive Retirement Program, for which Messrs. Lundgren and Loree were the only eligible named executive officers. The Company continued to offer these benefits to legacy employees of The Stanley Works following the Merger while Black & Decker employees continued to be covered under Black & Decker’s retirement programs. Mr. Archibald became

20

a participant in the Stanley Account Value Plan immediately following the Merger and also was covered under certain retirement plans sponsored by Black & Decker during 2010. The arrangements in which our named executive officers participated are described in more detail beginning on page 23 under the headings “Summary Compensation Table,” “Pension Benefits,” and “Non-Qualified Defined Contribution and Deferred Compensation Plans.” Effective January 1, 2011, the Company adopted revised retirement programs that to a large extent replace the programs that were in place prior to the Merger; those programs are described on pages 33-35 under the headings “Retirement Programs effective January 1, 2011.” The CEO Make-Whole Retirement Arrangement for Mr. Lundgren and The Stanley Works Supplemental Executive Retirement Program, which has been closed to new participants since 2007, were $4.00 from continuing operations,remain in place.

Employment Agreements

The Company has followed the practice of entering into a written employment agreement with its Chief Executive Officer for many years. Consistent with this practice, the Company entered into an employment agreement with John Lundgren in March, 2004, which represented a compounded annual growth ratewas amended and restated on December 10, 2008 to comply with rules enacted under Section 409A of 12.5% over the three years,Internal Revenue Code of 1986, as amended. In 2009, Mr. Lundgren’s agreement was again amended and ROCE, as defined above, was 16.9% for fiscal year 2007. As a result,restated in connection with the Merger and became effective upon completion of the Merger on March 12, 2010. In connection with the Merger, the Company also entered into written employment agreements with James M. Loree, its Executive Vice President and Chief Operating Officer, and Nolan D. Archibald, its Executive Chairman. Both of these agreements became effective upon completion of the Merger on March 12, 2010. Detailed descriptions of the employment agreements with Messrs. Lundgren, Loree Davis and McIlnay earned performance units equalArchibald are set forth under the heading “Executive Officer Agreements” on pages 35-37.

Change in Control Agreements and Severance Agreements

The Compensation Committee has determined that to 28,952; 14,186; 6,273be competitive with prevailing market practices, to enhance the stability of the executive team, and 8,685 shares, respectively.to minimize turnover costs associated with a corporate change in control, it is important to extend special severance protection for termination of employment as a result of a change in corporate control to certain employees. Therefore, the Company has entered into change in control agreements with certain members of senior management, including the named executive officers (other than Mr. Paternot didArchibald). Severance protections were established based on prevailing market practices when these agreements were put in place for each of our named executive officers. The severance benefits that would have been payable at December 31, 2010 to Messrs. Lundgren, Allan, Ansell and Loree in the event of termination following a change in control are set forth under the heading “Termination and Change in Control Provisions” beginning on page 37.

Perquisites

As a general rule, the Company does not receive an awardbelieve it is necessary for the 2005attraction or retention of executive talent to 2007 performance period as he was not an employeeprovide our executives with a substantial amount of the Company at the time those awards were granted.With the exception of the performance award to Mr. Paternot for the 2006 through 2008 performance period, targets for the 2006 through 2008 and 2007 through 2009 performance periods were established in the manner described above. In order to satisfy French tax and legal requirements, Mr. Paternot’s award in 2006 was madecompensation in the form of a grantperquisites. The Company does, however, provide its executive officers with some perquisites, including financial planning services, life and long-term disability insurance, car allowance, home security system services, executive medical exams, and up to $5,000 of performance-based restricted shares that will vest in three years only if the performance criteria are met over a three-year period. Mr. Paternot’s award was designedcompany products for Messrs. Lundgren and Archibald and $2,000 of company products for other executive officers as more fully set forth on page 24. The Company also agreed to continue to provide appropriate incentivesMr. Archibald with certain perquisites that he had been receiving as of December 31, 2008 pursuant to his employment agreement with Black & Decker prior to the Merger, including business and personal use of Black & Decker’s aircraft (now the Company’s aircraft), as is more fully set forth at page 24.

Other Compensation Policies

Stock Ownership Guidelines

In furtherance of the Company’s objective to create an ownership culture and because the Compensation Committee believes it is important for himexecutive officers and other senior employees to integrate the Facom Tools business with Stanley’s existing industrial tools business in Europe and to generate growthhave a meaningful investment in the combined business overCompany, we have established minimum guidelines for executive stock ownership. These guidelines require stock ownership to reach the performance period. Consistent withminimum levels laid out in the table below within a five-year period commencing on the date of hire or promotion to a senior management position. Awards to participants under the Company’s long-term incentive programs are subject to transferability restrictions to the extent that12

intention, a participant does not hold the performance criteria for Mr. Paternotminimum ownership levels at the time of grant were based on performance goals established for the Company’s Facom Tools business and the European industrial tools business as a whole. As a result of recent changes to Mr. Paternot’s role with the Company however, which are more fully detailed under the heading “Executive Officer Agreements” on page 24, two-thirds of Mr. Paternot’s performance based restricted shares awarded in 2006 will vest if the performance criteria over the 2006-2008 period are met. In addition, such performance criteria for Mr. Paternot are now based on corporate performance goals consistent with our other named executive officers rather than the performance of the Company’s Facom Tools and European industrial tools business. The Committee determined that the changes to the terms of Mr. Paternot’s LTIP performance award were required to both ensure Mr. Paternot’s compensation is fairly aligned with the changes in his role with the Company and is consistent with the Company’s objectives for compensating its executive officers.

distributed.

21

| | Minimum Ownership |

| CEO | | 300% of base salary |

| COO and CFO | | 200% of base salary |

| Other Executive Officers | | 100% of base salary |

Timing of Stock Option and RSU Grants.

With the exception of grants made to French participants, annual grants of stock options and restricted stock units to our executive officers and other eligible employees are usually made at a regularly scheduled meeting of the Compensation Committee held during the fourth quarter of each yearyear. The grant date of stock option and the grant dateRSU awards is the date of that meeting.the Board meeting held during the fourth quarter (typically the day after the Compensation Committee meeting) and grants to other eligible employees typically are approved on the same date. The exercise price for all stock option grants other than those to French participants is the average of the high and low price of a share as quoted on the New York Stock Exchange Composite Tape on the date of grant. The grant date for grantsawards to French participants is the first date on which grants may be made consistent with French legal and tax requirements following the date of the Committee meeting aton which other annual grants are made and the grantto our other employees. The exercise price of stock options for French participants is the higher of the average of the high and low stock price of a share on the date of grant and 80% of the average opening price on the New York Stock Exchange for the 20 days preceding the date of grant.

The Compensation Committee may alsooccasionally make occasionaloff-cycle grants during the year andyear. These are typically associated with promotions, hiring, acquisitions, or other significant business events that would likely have an adverse impact on our ability to retain management talent. The Compensation Committee has delegated authority to the Company’s Chief Executive Officer the authority to make annual grants and occasional “off cycle”off-cycle grants to employees who are not executive officers of the Company. These grants are typically associated with promotions, acquisitions and hiring; theThe grant date for occasionalany grants made by the Company’s Chief Executive Officer is either the date the grant authorization is signed by the Chief Executive Officer or a later date specified in the grant authorization. The grant price for all stock option grants other than those to French Participants is the average of the high and low price of a share as quoted on the New York Stock Exchange Composite Tape on the date of grant. Special Bonus ProgramIn July, 2007, the Company issued to certain members of management and key employees awards pursuant to a special bonus program. The awards were approved by the Committee on May 23, 2007 under the Company’s 1997 Long-Term Incentive Plan. These awards can be earned independently of others that were extended to executive officers earlier in the year. The special award program provides senior managers the opportunity to receive stock, and other eligible participants the opportunity to receive cash in the event company-wide objectives relating to working capital turns and inventory turns are achieved by December 31, 2009 and the working capital turns objective is sustained for a period of at least six months. The Committee approved this program in the belief that the achievement of these goals will signal a material elevation in the Company’s overall performance standards, beyond that measured by reference to planned levels of EPS growth and ROCE, and that attainment of the working capital and inventory turn objectives will materially benefit the Company’s investors. In this regard, the Committee believes the likelihood of missing the goals is at least as high as the likelihood of achieving the goals. Bonuses will be distributed promptly following achievement of the established goals.

The performance goals that will provide the basis for determining bonus amounts have been approved by the Committee. The maximum award payable to our named executive officers is as follows: Mr. Lundgren, 10,000 shares of stock; Mr. Loree, 7,000 shares; Mr. McIlnay, 2,000 shares; and Mr. Davis, 2,000 shares. Mr. Paternot is not eligible to participate in this special bonus program.

Post-Termination Benefits

Retirement Benefits. The Committee believes that it is important to offer the full complement of compensation and benefit programs that typify those extended to senior executives in the Company’s market for senior executive talent. Therefore, the Company has in effect various retirement programs, consisting of the

13

Stanley Account Value Plan; the Supplemental Retirement and Account Value Plan for Salaried Employees of The Stanley Works; The Stanley Works Supplemental Executive Retirement Plan; and a CEO Make-Whole Retirement Arrangement for Mr. Lundgren. Mr. Loree is the only named executive officer who participates in The Stanley Works Supplemental Executive Retirement Plan. Each of these arrangements is described in more detail beginning on page 16 under the headings “Summary Compensation Table,” “Pension Benefits,” and “Non-Qualified Defined Contribution and Deferred Compensation Plans.” Mr. Paternot does not participate in any of these plans, but does participate in a retirement plan provided by his employer, Stanley Doors France SAS to its directors. Under that plan, Stanley Doors France and Mr. Paternot make contributions to a fund that is managed by an independent third party. Mr. Paternot would receive certain disbursements from that fund upon retirement. Stanley Doors France has no obligations with respect to that fund beyond the obligation to make contributions during the term of Mr. Paternot’s employment.

Employment and Change in Control Agreements; Severance Agreements. For many years, the Company has followed the practice of entering into a written employment agreement with its Chief Executive Officer. Consistent with this practice, the Company entered into an employment agreement with John Lundgren in March, 2004. In negotiating the terms of that agreement, the Company considered Mr. Lundgren’s experience, his prior compensation, the compensation of his predecessor at the Company and, with assistance from its compensation consultant, the prevailing market practice for Chief Executive Officer compensation. The Committee has determined that Mr. Lundgren’s current salary and compensation package are at the median for Chief Executive Officers with similar responsibilities at comparable companies. A detailed description of Mr. Lundgren’s employment agreement is set forth under the heading “Executive Officer Agreements” on page 24.

Mr. Paternot served as the President of Facom S.A. prior to the Company’s acquisition of the Facom Tools business. In the course of its due diligence, the Company determined that Mr. Paternot’s continued employment would help ensure the success of the Facom business following the acquisition and the successful integration of that business with the Company’s existing industrial tools business in Europe. Mr. Paternot’s employment agreement therefore was negotiated as part of the negotiations to acquire the Facom Tools business and became effective upon the closing of the transaction on January 2, 2006. His compensation package was designed to be commensurate with the compensation provided by his previous employer and to provide appropriate incentives for him to integrate the Facom Tools business with the Company’s European Tools business and to remain with the Company for a minimum of three years. As a result of recent changes to Mr. Paternot’s role with the Company, his employment agreement has been amended along with commensurate changes to his compensation package to be more fairly aligned with the changes in his role with the Company and to be consistent with the Company’s objectives for compensating its executive officers. A detailed description of Mr. Paternot’s employment agreement, as amended, is set forth under the heading “Executive Officer Agreements” on page 24.

The Committee has determined that to be competitive with prevailing practices, it is important to extend special severance protection when employment is terminated as a result of a change in corporate control. As a result, the Company has entered into change in control agreements with certain members of senior management, including Messrs. Lundgren, Loree, Davis and McIlnay. In these agreements, the Company seeks to help foster retention by providing appropriate levels of severance protections to appropriate members of management based on prevailing market practices. The benefits that would be received by Messrs. Lundgren, Loree, Davis and McIlnay in the event of termination following a change in control are set forth under the heading “Termination and Change in Control Provisions” on page 25.

Perquisites

The Company does not believe it is necessary for the attraction or retention of management talent to provide our executives with a substantial amount of compensation in the form of perquisites. In 2007, the only perquisites provided to the Company’s executive officers were financial planning services, life and long term disability insurance, car allowance, home security system service and executive medical exams as more fully detailed on page 17.

14

Tax Deductibility Under Section 162(m)

Under Section 162(m) of the Internal Revenue Code, the Company may not be able to deduct certain forms of compensation in excess of $1,000,000 paid to any of the named executive officers thatwho are employed by the Company at year-end. The Company believes that it is generally in the Company’s best interests to satisfy the requirements for deductibility under Section 162(m). Accordingly, the Company has taken appropriate actions, to the extent it believes feasible, to preserve the deductibility of annual incentive and long-term performance awards. However, notwithstanding this general policy, the Company also believes there may be circumstances in which the Company’s interests are best served by maintaining flexibility in the way compensation is provided, whether or not compensation is fully deductible under Section 162(m). Minimum Stock Ownership GuidelinesIn furtherance of the Company’s policy to create an ownership culture and because the Company believes it is important for executive officers and other senior employees to have a meaningful investment in Stanley, the Company has established guidelines for minimum stock ownership. These guidelines provide that over a five-year period commencing on the date of hire or promotion to a senior management position, stock ownership will reach the following minimum levels, expressed as a multiple of base salary: three times for the chief executive officer; two times for the Executive Vice President and Chief Financial Officer; and one time for other executive officers and certain other members of senior management. Consistent with this policy, awards to participants under the Company’s long term performance award program will be settled in shares of common stock that are subject to transferability restrictions to the extent that a participant does not hold the minimum ownership levels specified in the policy at the time of distribution of the award.

Hedging; Pledging

The Company’s Board of Directors has adopted a policy against hedging transactions and discouraging pledging transactions. Pursuant to the policy, hedging is not permitted, and any officer, director or employee who wishes to pledge shares must obtain the prior approval of the General Counsel. A copy of thisThis policy is included in the Company’s Business Conduct Guidelines, which are available on the “Corporate Governance” section of the Company’s website atwww.stanleyworks.comwww.stanleyblackanddecker.com. Forfeiture of Awards in the Event of Restatement The Company’s Board of Directors has adopted a “recoupment” policy relating to unearned incentive compensation of executive officers. Pursuant to this policy, in the event our Board or an appropriate committee thereof determines that any fraud, negligence or intentional misconduct by an executive officer was a significant contributing factor to the Company having to restate all or a portion of its financial statements, the Board or committee will take, in its discretion, such action as it deems necessary to remedy the misconduct and prevent its recurrence. Such actions may include requiring reimbursement of bonuses or incentive compensation paid to the officer after January 1, 2007, requiring reimbursement of gains realized upon the exercise of stock options, and cancellation of restricted or deferred stock awards and outstanding stock options. In determining what actions are appropriate, the Board or committee will take into account all relevant factors, including whether the restatement was the result of fraud, negligence or intentional misconduct. A copy of this policy is available on the “Corporate Governance” section of the Company’s website atwww.stanleyworks.comwww.stanleyblackanddecker.com.15

22

Assessment of Risk Arising from Compensation Policies and Practices

The Compensation Committee has considered whether the Company’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company and has concluded that the Company’s compensation policies and practices do not create such risks.

Summary Compensation TableThis

The table showsbelow summarizes the total compensation earned for service in all capacities during fiscal years 2007 and 2006the applicable periods for Stanley’sthose individuals who served as Chief Executive Officer or Chief Financial Officer of the Company during the fiscal year ended January 1, 2011 (“fiscal year 2010”) and for the three other most highly compensated executive officers. | | | | | | | | | | | | | | | | | | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (j) |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock

Award(s)

($) | | Option

Awards ($) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | All

Other

Compensation ($) | | Total |

John F. Lundgren, | | 2007 | | 1,000,000 | | 0 | | 1,200,449 | | 723,409 | | 1,700,000 | | 179,277 | | 323,240 | | 5,126,375 |

Chairman and CEO | | 2006 | | 833,333 | | 0 | | 2,679,335 | | 974,912 | | 1,303,879 | | 138,116 | | 234,139 | | 6,163,714 |

| | | | | | | | | |

James M. Loree, | | 2007 | | 580,000 | | 0 | | 534,507 | | 499,116 | | 788,800 | | 165,883 | | 163,149 | | 2,731,455 |

Executive Vice President and CFO | | 2006 | | 555,000 | | 0 | | 1,087,049 | | 748,762 | | 501,994 | | 179,807 | | 124,092 | | 3,196,704 |

| | | | | | | | | |

Hubert W. Davis, Jr., | | 2007 | | 351,250 | | 0 | | 174,496 | | 126,113 | | 346,800 | | 0 | | 103,410 | | 1,102,069 |

Senior Vice President, Business Transformation | | 2006 | | 340,000 | | 0 | | 406,248 | | 207,150 | | 221,659 | | 0 | | 102,240 | | 1,277,297 |

| | | | | | | | | |

Donald R. McIlnay, | | 2007 | | 415,000 | | 0 | | 225,735 | | 169,816 | | 251,490 | | 0 | | 105,747 | | 1,167,788 |

Senior Vice President and President, Industrial Tools Group and Emerging Markets | | 2006 | | 401,250 | | 0 | | 569,754 | | 152,386 | | 160,307 | | 0 | | 67,923 | | 1,351,620 |

| | | | | | | | | |

Thierry Paternot, | | 2007 | | 571,791 | | 0 | | 0 | | 617,990 | | 788,386 | | 0 | | 42,928 | | 2,021,095 |

President, Stanley Tools-Europe | | 2006 | | 628,400 | | 0 | | 95,291 | | 1,072,500 | | 743,555 | | 0 | | 18,799 | | 2,558,545 |

officers of the Company serving as such at the end of fiscal year 2010 other than the CEO and CFO (collectively the “named executive officers”).

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (j) |

| | | | | | | | | | | | | | | Change in | | | | |

| | | | | | | | | | | | | | | Pension Value | | | | |

| | | | | | | | | | | | | | | and | | | | |

| | | | | | | | | | | | | | | Nonqualified | | | | |

| | | | | | | | | | | | | Non-Equity | | Deferred | | All | | |

| | | | | | | | | Stock | | Option | | Incentive Plan | | Compensation | | Other | | |

| Name and | | | | Salary | | Bonus | | Award(s) | | Awards | | Compensation | | Earnings | | Compensation | | |

| Principal Position | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) | | Total |

| John F. Lundgren, | | 2010 | | 1,208,433 | | 0 | | 25,347,725 | | 1,255,500 | | 4,342,800 | | 159,663 | | 416,138 | | 32,730,259 |

| President and CEO | | 2009 | | 1,050,000 | | 0 | | 5,091,241 | | 893,250 | | 2,100,000 | | 379,550 | | 88,476 | | 9,602,517 |

| | | 2008 | | 1,041,667 | | 0 | | 1,829,068 | | 1,655,000 | | 1,213,210 | | 0 | | 318,619 | | 6,057,564 |

| | | | | | | | | | | | | | | | | | | |

| Donald Allan, Jr., | | 2010 | | 443,850 | | 0 | | 4,002,349 | | 334,800 | | 848,920 | | 0 | | 125,656 | | 5,755,575 |

| Senior Vice President and | | 2009 | | 350,000 | | 0 | | 804,639 | | 178,650 | | 420,000 | | 0 | | 33,500 | | 1,786,789 |

| CFO | | 2008 | | 287,500 | | 0 | | 279,771 | | 43,275 | | 152,864 | | 0 | | 50,429 | | 813,839 |

| | | | | | | | | | | | | | | | | | | |

| Jeffery D. Ansell, | | 2010 | | 456,250 | | 290,000 | | 4,002,349 | | 334,800 | | 878,560 | | 0 | | 132,555 | | 6,094,514 |

| Senior Vice President & | | 2009 | | 400,000 | | 0 | | 837,140 | | 178,650 | | 480,000 | | 0 | | 37,516 | | 1,933,306 |

| Group Executive, | | 2008 | | 391,666 | | 0 | | 382,096 | | 86,550 | | 290,800 | | 0 | | 70,666 | | 1,221,778 |

| Construction & DIY | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Nolan D. Archibald | | 2010 | | 1,187,500 | | 0 | | 3,325,031 | | 19,665,004 | | 1,875,000 | | 1,579,878 | | 604,152 | | 28,236,565 |

| Executive Chairman | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| James M. Loree, | | 2010 | | 720,833 | | 0 | | 14,945,442 | | 837,000 | | 1,914,960 | | 530,983 | | 293,685 | | 19,242,903 |

| Executive Vice President | | 2009 | | 610,000 | | 0 | | 2,307,946 | | 595,500 | | 976,000 | | 258,922 | | 60,661 | | 4,809,429 |

| and COO | | 2008 | | 605,000 | | 0 | | 1,053,760 | | 288,500 | | 562,929 | | 0 | | 159,925 | | 2,670,114 |

Footnote to Column (a) of Summary Compensation Table

Mr. Paternot’s compensation is paidArchibald was elected Executive Chairman of the Company effective March 12, 2010, in Euros. Forconnection with the fiscal year 2007, it has been converted into dollars using the average U.S. Dollar to Euro exchange rate for the twelve month period ending December 29, 2007 that was usedMerger. The information included in the preparationSummary Compensation Table does not include compensation earned by Mr. Archibald in his role as Chairman and Chief Executive Officer of The Black & Decker Corporation prior to the Company’s financial results for that period. That rate is 1.3723 U.S. Dollars per Euro. ForMerger.

Footnote to Column (d) of Summary Compensation Table

The amount set forth in this column reflects a bonus paid to Mr. Ansell in connection with his relocation to Maryland following the fiscal year 2006, it was converted into dollars using the average U.S. Dollar to Euro exchange rate for the twelve month period ending December 30, 2006 that was used in the preparation of the Company’s financial results for that period. That rate was 1.2568 U.S. Dollars per Euro.Merger.

Footnote to Column (e) of Summary Compensation Table

This column reflects the dollar amount associated withaggregate grant date fair value of all outstanding restricted stock units and performance awards recognized for financial statement reporting purposes with respect togranted during the fiscal years ended December 29, 2007January 1, 2011, January 2, 2010, and December 30, 2006,January 3, 2009, respectively, in accordance with FAS 123(R).Financial Accounting Standards Board Codification Topic 718—Stock Compensation. See footnote KJ of the Company’s report on Form 10-K for the applicable fiscal year for assumptions used in the valuation of these awards and related disclosures.

The grant date fair value of performance award grants included in this column, assuming performance at maximum, for grants made in fiscal years 2010, 2009, and 2008, respectively, is as follows: Mr. Lundgren, $7,297,936/$2,869,980/$2,791,166; Mr. Allan, $1,026,944/$382,641/$186,078; Mr. Ansell, $1,026,944/$437,336/$390,728; Mr. Loree, $3,365,271/$1,111,561/$863,351. The dollar amounts listed do not necessarily reflect the dollar amounts of compensation actually realized or that may be realized by our named executive officers.

Footnote to Column (f) of Summary Compensation Table

This column reflects the dollar amount associated withaggregate grant date fair value of all outstanding stock option awards recognized for financial statement reporting purposes with respect tooptions granted during the fiscal yearyears ended December 29, 2007January 1, 2011, January 2, 2010, and December 30, 2006,January 3, 2009, respectively, in accordance with FAS 123(R).Financial Accounting Standards Board Codification Topic 718—Stock Compensation. See footnote KJ of the Company’s report on Form 10-K for the applicable fiscal year for assumptions used in the valuation of these awards and related disclosures.

Footnote to Column (g) of Summary Compensation Table

The dollar amounts set forth in this column reflect (i) incentive compensation earned pursuant to the 2007-2009 Special Bonus Program, which were paid in cash in July 2010, and (ii) incentive compensation earned pursuant to the Company’s MICP for the applicable2010 fiscal year, which for 2007 vested upon distribution in the first quarter of 2008 and for 2006 vested upon distribution in the first quarter of 2007.

2011 calendar year.

23

Footnote to Column (h) of Summary Compensation Table

The following amounts included in this column are attributable to the following plans:

Increase in actuarial present value of Mr. Lundgren’s benefit under the CEO Make-Whole Retirement Arrangement for fiscal year

2007—$179,277.2010 – $159,663. See the footnote to Column

(b)(d) of Pension Benefits Table on page

2131 for the assumptions used in making this calculation. For fiscal year

2006,2009, the increase in actuarial present value of Mr. Lundgren’s benefit under the CEO Make-Whole Retirement Arrangement was

$138,116.16

$379,550. For fiscal year 2008, there was no increase in actuarial present value of Mr. Lundgren’s benefit under the CEO Make-Whole Retirement Arrangement.

Increase in actuarial present value of Mr. Archibald’s benefit for the period March 12, 2010 through January 1, 2011 for the plans in which he was a participant are as follows: $14,216 under The Black & Decker Pension Plan, $847,303 under The Black & Decker Supplemental Executive Retirement Plan, and $718,359 under The Black & Decker Supplemental Pension Plan. See the footnote to Column (d) of the Pension Benefits Table on page 31 for the assumptions used in making these calculations.

Increase in actuarial present value of Mr. Loree’s benefit under The Stanley Works Supplemental Executive Retirement

PlanProgram for fiscal year

2007—$165,883.2010 -- $530,983. See the footnote to Column

(b)(d) of Pension Benefits Table on page

2131 for the assumptions used in making this

calculationcalculation. For fiscal year

2006,2009, the increase in actuarial present value of Mr. Loree’s benefit under The Stanley Works Supplemental Executive Retirement

PlanProgram was

$179,807.$258,922. For fiscal year 2008, there was no increase in actuarial present value of Mr. Loree’s benefit under The Stanley Works Supplemental Executive Retirement Program.

Footnote to Column (i) of Summary Compensation Table

Consists of companyThis column reflects Company contributions and allocations for Messrs. Lundgren, Allan, Ansell, and Loree Davis and McIlnay under Thethe Stanley Works Account Value Plan (matching and Cornerstone) and the Supplemental Retirement and Account Value Plan for Salaried Employees of The Stanley Works (supplemental matching and supplemental Cornerstone), company contributions andmatching allocations under the Stanley Account Value Plan for Mr. Paternot to a defined contribution plan maintained by Stanley Doors France SAS that is tax-qualified under French law,Archibald, and life insurance premiums, car allowance, cost of financial planning services, and cost of annual physical, cost of products acquired through the Company’s Product Programs, reimbursement for club dues, personal use of tickets to athletic and other entertainment events, and cost of a home security system as set forth in the table below. In addition, spouses of Messrs. Lundgren, Loree and Allan joined the executives on a business trip for which they traveled on the Company aircraft. There was no incremental cost to the Company associated with this travel. Perquisites provided to Mr. Archibald also include personal use of a Company car and Company aircraft; the cost incurred by the Company for such use is reflected below. Certain contributions to the Stanley Account Value Plan and the Supplemental Retirement and Account Value Plan for Mr.Messrs. Lundgren and Loree will offset pension benefits as described on pages 21-22.

| | | | | | | | | | | | | | |

| | | | | | | | |

Name | | Year | | Defined

Contribution

Plans ($) | | Insurance ($) | | Car ($) | | Financial

Planning ($) | | Home

Security

System ($) | | Column (i)

Total ($) |

John F. Lundgren | | 2007 | | 207,349 | | 46,423 | | 16,750 | | 17,994 | | 34,724 | | 323,240 |

James M. Loree | | 2007 | | 91,969 | | 13,655 | | 16,750 | | 11,443 | | 29,332 | | 163,149 |

Hubert W. Davis, Jr. | | 2007 | | 71,769 | | 14,329 | | 17,312 | | 0 | | 0 | | 103,410 |

Donald R. McIlnay | | 2007 | | 71,913 | | 17,084 | | 16,750 | | 0 | | 0 | | 105,747 |

Thierry Paternot | | 2007 | | 15,547 | | 2,371 | | 25,010 | | 0 | | 0 | | 42,928 |

page 31.

| | | | | Defined | | �� | | | | | | | | | | | | | | Home | | Personal Use | | Personal Use | | |

| | | | | Contribution | | | | | | Financial | | Annual | | Product | | Club | | | | Security | | of Corporate | | of Company | | Column (i) |

| | | | | Plans | | Insurance | | Car | | Planning | | Physical | | Program | | Dues | | Tickets | | System | | Aircraft | | Car | | Total |

| Name | | Year | | ($) | | ($) | | ($) | | ($) | | ($) | | $ | | ($) | | ($) | | ($) | | ($) | | ($) | | ($) |

| John F. Lundgren | | 2010 | | 306,000 | | 67,463 | | 19,195 | | 19,281 | | 0 | | 682 | | 0 | | 0 | | 3,516 | | 0 | | 0 | | 416,138 |

| Donald Allan, Jr. | | 2010 | | 92,422 | | 11,963 | | 19,273 | | 0 | | 0 | | 1,997 | | 0 | | 0 | | 0 | | 0 | | 0 | | 125,656 |

| Jeffery D. Ansell | | 2010 | | 109,127 | | 8,074 | | 15,354 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 132,555 |

| Nolan D. Archibald | | 2010 | | 2,156 | | 1,224 | | 16,200 | | 39,676 | | 0 | | 2,635 | | 1,820 | | 4,528 | | 0 | | 526,391 | | 9,522 | | 604,152 |

| James M. Loree | | 2010 | | 142,183 | | 14,500 | | 16,657 | | 9,641 | | 0 | | 754 | | 0 | | 0 | | 109,950 | | 0 | | 0 | | 293,685 |

The Stanley Account Value Plan iswas a Section 401(k) retirement program that coverscovered certain employees of Stanleythe Company and its U.S. affiliates who are subject to the income tax laws of the United States. The Plan featuresfeatured two accounts: the “Choice Account” and the “Cornerstone Account.” As discussed more fully in the section titled “

Retirement Programs effective January 1, 2011,” the Company amended and restated the Stanley Account Value Plan effective January 1, 2011; the discussion below summarizes the benefits of the Stanley Account Value Plan that were in effect through the end of 2010. The Choice Account offersoffered eligible participants the opportunity for tax-deferred savings and with respect to certain funds, a choice of investment options. For each calendar year prior to 2009, and for the 2010 calendar year, the Company providesprovided a 50% match on the first 7% of pay contributed by a participant on a pre-tax basis for the year. Annual pay and the amount of elective contributions arewere subject to limits set forth in the tax law. Participants arewere permitted to direct the investment of all funds credited to their Choice Accounts. Matching allocations to the Choice Accounts are 100% vested once a participant has completed three years of service, but, except as described below, are not vested prior to the completion of three years of service. As described more fully in the section titled “

Non-Qualified Defined Contribution and Deferred Compensation Plans” below, the Company decided at the end of 2008 that matching allocations would not be made for at least calendar year 2009, but restored half of that match (i.e., a 25% match) retroactive to January 1, 2009 at the end of 2009 and fully reinstated matching contributions, at 2008 levels, effective January 1, 2010. The Cornerstone Account

providesprovided a “core” retirement benefit for certain participants. This account

iswas 100% funded by separate allocations that are not dependent on contributions by participants.

TheThese allocations were made for years prior to 2009 and in 2010; no allocation was made in 2009. Effective June 2008, the Cornerstone Account

is notbecame subject to a participant’s investment direction. The regular allocation to a participant’s Cornerstone Account for a calendar year

iswas based on the participant’s age on the last day of the calendar year and the participant’s pay (subject to limits set forth in the tax law) for each calendar quarter during the year (with pay recognized for a calendar quarter only if the participant

hashad employment status on the last day of the calendar quarter) as follows:

| | |

| |

| Age | | Allocation Amount (% of Pay) |

Less than 40 | | 3% |

40 - 54 | | 5% |

55 and older | | 9% |

There were additional Cornerstone allocations for years prior to 2009 and in 2010 for certain participants. None of the Company’s named executive officers was eligible for these additional Cornerstone allocations.

Allocations to the Cornerstone Account are 100% vested once a participant has completed three years of service and,

except as described below, are not vested prior to the completion of three years of service. In addition, regardless of years of service, a participant will become 100% vested in the total value of both the Choice Account and the Cornerstone Account if, while the participant is employed by the Company, the participant reaches age 65 or becomes totally and permanently disabled or dies. If a participant dies while employed by the Company, the total value of the participant’s accounts will be payable to his or her beneficiary.

As previously described, the Company decided that allocations to a Cornerstone Account would not be made for calendar year 2009; the Company reinstated Cornerstone allocations at 2008 levels effective January 1, 2010.

The CEO Make-Whole Retirement Arrangement and The Stanley Works Supplemental Executive Retirement PlanProgram are described on pages 21-2233-34 under the heading “Pension Benefits.” The Supplemental Retirement and Account Value Plan for Salaried Employees of The Stanley Works is described on pages 22-2334-35 under the heading “Non-Qualified“Non-Qualified Defined Contribution and Deferred Compensation Plans.Plans.” The amounts under the

Columncolumn entitled “Financial Planning” for Messrs. Lundgren,

Archibald, and Loree include reimbursement for taxes owed with respect to such benefit in the amounts of

$7,4598,281; 10,165 and

$4,743,4,141 respectively; the amounts under the columns entitled Personal Use of Corporate Aircraft and Personal Use of Company Car for Mr. Archibald include reimbursement for taxes owed with respect to such benefits in the amounts of 27,733 and 2,040, respectively.

17

24

Grants of Plan Based Awards Table 20072010 Grants This table sets forth information concerning equity grants to the

Named Executive Officersnamed executive officers during the fiscal year ended

December 29, 2007January 1, 2011 as well as the range of future payouts under non-equity incentive

plans. | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Name | | Grant Date | | Estimated Future Payouts Under

Non-Equity Incentive Plan Awards | | Estimated Future Payouts Under

Equity Incentive Plan Awards | | All Other

Stock

Awards:

Number

of Shares

of Stock

or Units

(#) | | All Other

Option

Awards:

Number of

Securities

Underlying

Options (#) | | Exercise

or Base

Price of

Option

Awards ($/Sh) | | Closing

price at

Date of

Grant

($/Sh) | | Grant Date Fair Value of Stock and

Option Awards ($) |

| | | Threshold

($) | | Target ($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | | | | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | (j) | | (k) | | | | (l) |

John F. Lundgren | | February 21, 2007 | | 500,000 | | 1,000,000 | | 2,000,000 | | | | | | | | | | | | | | | | | | | |

| | March 30, 2007 | | | | | | | | 9,045 | | 18,090 | | 36,179 | | | | | | | | | | | | $ | 472,141 |

| | July 23, 2007 | | | | | | | | 0 | | 4,740 | | 10,000 | | | | | | | | | | | | $ | 281,272 |

| | December 10, 2007 | | | | | | | | | | | | | | 18,750 | | | | | | | | | | $ | 958,594 |

| | December 10, 2007 | | | | | | | | | | | | | | | | 75,000 | | $ | 51.13 | | $ | 51.14 | | $ | 907,500 |

| | | | | | | | | | | | |

James M. Loree | | February 21, 2007 | | 232,000 | | 464,000 | | 928,000 | | | | | | | | | | | | | | | | | | | |

| | March 30, 2007 | | | | | | | | 4,197 | | 8,394 | | 16,787 | | | | | | | | | | | | $ | 219,080 |

| | July 23, 2007 | | | | | | | | 0 | | 3,318 | | 7,000 | | | | | | | | | | | | $ | 196,891 |